Key Changes in the Income Tax Bill, 2025

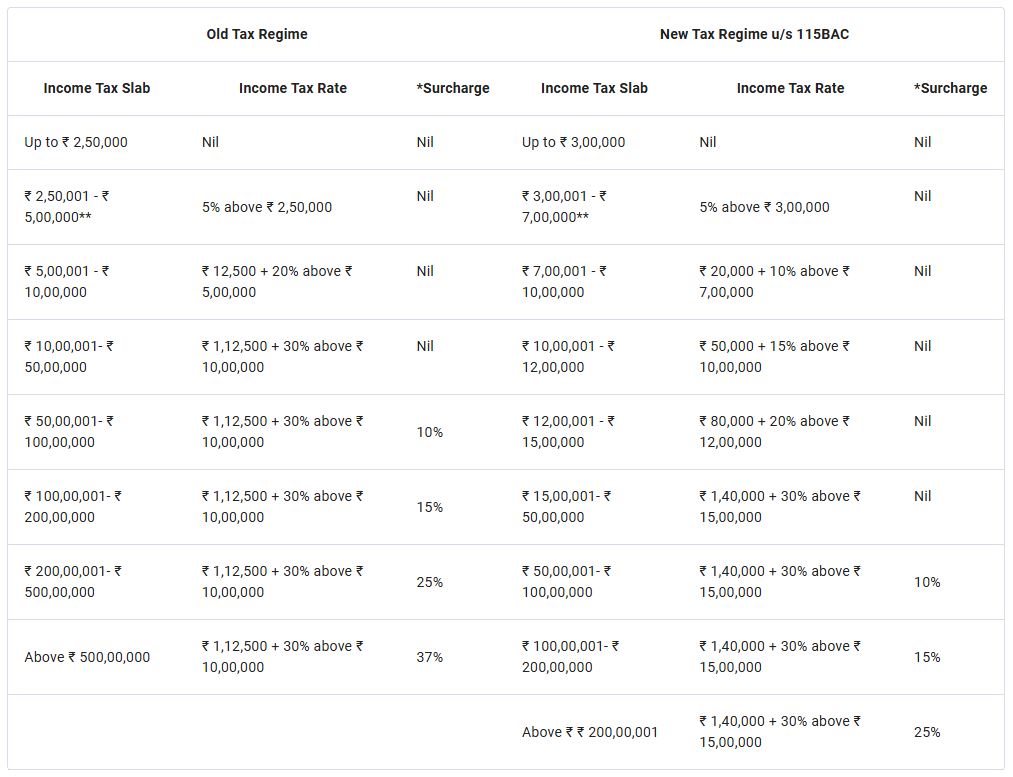

Tax Slabs and Rates for AY 2025-26

The income tax slabs for AY 2025-26 have been updated to reflect a more modern and equitable approach to taxation. These revisions aim to balance the tax burden more evenly across different income groups. The new slabs are structured to offer potential relief to lower and middle-income earners while ensuring that higher earners contribute their fair share.

Here’s a brief overview of the updated tax slabs:

These changes could influence your overall tax liability significantly, so it’s important to understand which slab your income falls into. Adjusting your financial planning according to the new rates can help you manage your finances more effectively. For those with varying income sources, it might be beneficial to consult with a tax advisor to maximize any potential benefits from these updates.

Additionally, these new slabs are part of broader efforts to simplify the tax system and make it more transparent. By restructuring the rates, the government aims to make tax compliance more straightforward for everyone, reducing the complexities that taxpayers often face. Staying informed about these changes can help you take advantage of any opportunities to optimize your tax obligations under the new system.

Remember, these adjustments are designed to provide a more balanced approach to taxation, potentially making the process more manageable and less burdensome for a wide range of taxpayers.

Deductions Available Under New Tax Regime

One of the significant aspects of the new tax regime is the availability of specific deductions. For those paying interest on housing loans, Section 24(b) offers a way to claim deductions, potentially making homeownership more affordable by reducing taxable income. Additionally, employer contributions to pension funds under Section 80CCD(2) are eligible for deductions, encouraging more robust retirement savings.

Medical expenses are another area where you can claim deductions. Section 80D allows for deductions on premiums paid for health insurance policies for yourself, your family, and your parents. This provision can ease the financial burden of healthcare costs, providing you with better peace of mind.

Moreover, contributions to charitable organizations approved under Section 80G can also be deducted, supporting both your tax planning and philanthropic goals. This can be an effective way to reduce your tax liability while contributing to causes you care about.

For those with disabilities or supporting family members with disabilities, Section 80DD and Section 80U offer additional deductions. These sections provide financial relief to individuals by allowing deductions for expenses related to the treatment, training, and rehabilitation of dependents with disabilities, as well as for self-suffering from specified disabilities.

Taking advantage of these deductions can lead to substantial tax savings, so it’s worth exploring how they apply to your situation. Consulting with a tax advisor can help you identify and maximize these benefits, ensuring that you make the most of the available provisions under the new tax regime. By strategically planning your finances and understanding these deductions, you can effectively manage your tax obligations while also supporting your financial well-being.

New vs Old Tax Regime

The introduction of Section 115BAC has made the new tax regime the default choice for taxpayers. However, there remains an option to opt-out and continue with the old tax regime if it better suits your financial strategy. It’s important to note that regardless of the chosen regime, a Health & Education cess at 4% applies to the income tax amount plus any applicable surcharge. This consistent application ensures that essential public services continue to receive necessary funding. Comparing the benefits and drawbacks of each regime can help you decide which is more advantageous for your personal or business finances.

The new tax regime offers simplified tax filing with reduced deductions and exemptions. This can be beneficial for taxpayers who prefer straightforward calculations and do not have significant deductions to claim. On the other hand, the old tax regime allows for numerous exemptions and deductions, which can be advantageous if you have eligible expenses that reduce your taxable income.

Key deductions that are not available in the new regime include those for housing loan interest, contributions to pension funds, and health insurance premiums. If these deductions significantly lower your tax liability, you might find the old regime more beneficial.

For individuals with business or professional income, both regimes require careful consideration. The old regime may offer more substantial tax savings through various deductions, while the new regime simplifies the process by eliminating the need to track numerous claims.

Choosing between the new and old tax regimes requires a detailed assessment of your financial situation. Consulting a tax advisor can help you navigate the options and select the regime that aligns with your financial goals. Understanding the impact of each regime on your overall tax liability is crucial for effective tax planning and management.

ITR Forms for Business/Profession Income

Understanding the right ITR forms for business or professional income is key to a smooth tax filing experience. For individuals and Hindu Undivided Families (HUFs) with income from business or profession, the appropriate form is ITR-3. This form covers income from a proprietary business or profession, ensuring all relevant financial details are accurately captured.

On the other hand, ITR-4 (SUGAM) is suitable for individuals, HUFs, and firms opting for the presumptive income scheme under Sections 44AD, 44ADA, and 44AE of the Income Tax Act. This form simplifies the tax filing process by assuming a fixed percentage of income as profit, reducing the need for detailed accounting records.

It’s crucial to choose the correct form to ensure compliance with tax regulations and avoid any potential penalties. For example, using ITR-4 (SUGAM) can be a straightforward option if your business or professional income qualifies for the presumptive taxation scheme, as it minimizes paperwork and the need for extensive documentation. However, if your financial activities are more complex, ITR-3 might be more appropriate to capture all necessary details.

Filing the right ITR form also helps in claiming relevant deductions and accurately reporting your income, ensuring that your tax liability is calculated correctly. Keeping organized records and staying informed about the required forms can make the tax filing process more manageable and efficient. If you’re unsure about which form to use, consulting with a tax advisor can provide clarity and help you navigate the complexities of income tax filing for business or professional income.

Form Details for Taxpayers

Navigating the various forms required for tax filing can feel overwhelming, but understanding their purposes can make the process much more manageable. Form 16A is essential for those who receive income other than salary, as it provides a summary of the taxes that have been deducted at source. This form is particularly useful for individuals with diverse income streams, ensuring all tax credits are accurately reported.

Form 26AS, on the other hand, acts as a consolidated statement of your tax information. It includes details of tax deducted at source (TDS), tax collected at source (TCS), advance tax, and self-assessment tax payments. Reviewing this form helps you verify that all tax payments and deductions are correctly recorded, preventing any discrepancies when you file your return.

The Annual Information Statement (AIS) complements Form 26AS by providing a broader overview of your financial transactions, such as income from savings accounts, dividends, and securities. Keeping an eye on this form can help you stay on top of your financial activities throughout the year.

Ensuring you have these forms handy and up-to-date is a key part of smooth tax filing. By staying organized and familiar with these documents, you can reduce the chances of errors and streamline your tax preparation process. If you’re ever in doubt about which forms to use or how to interpret them, consulting with a tax advisor can offer valuable guidance.

For businesses and professionals, grasping the significance of audit and declaration forms is crucial for tax compliance and optimization. Form 3CB-CD is necessary for accounts audit under Section 44AB, offering a comprehensive report of financial activities. It ensures that your financial records meet the regulatory standards and helps in identifying areas for potential tax savings. In addition, Forms 15G and 15H are used to claim TDS exemption on interest income, which can be particularly beneficial for those whose total income falls below the taxable threshold. By submitting these forms, eligible individuals can reduce their taxable income and avoid unnecessary deductions. Understanding these forms and their purposes can significantly aid in aligning with tax regulations while optimizing your tax obligations. It’s always a good idea to keep these forms in mind during your financial planning to ensure compliance and take advantage of available benefits. If you have any doubts or need personalized advice, consulting with a tax advisor can provide valuable insights and guidance, making the process less daunting and more efficient.